Hello you!!

Most probably, you need to file your return and that too paying minimum tax. And that is why you have come up here.

No problem, Why professionals are there. Just find everything here or otherwise let me know. Although this blog and its length may look oh-my-god to you, but this is what our law has.

Without taking much of your time, here we go.

This blog is in three parts:

1. Hii-Hello which you have covered.

2. List of deductions available to Individuals Including Salaried persons.

3. List of benefits available to Salaried Persons.

Here is the first part of Blog, relating to Individual (and also for Salaried) taxpayers :

List of benefits available to Salaried Persons

Most probably, you need to file your return and that too paying minimum tax. And that is why you have come up here.

No problem, Why professionals are there. Just find everything here or otherwise let me know. Although this blog and its length may look oh-my-god to you, but this is what our law has.

Without taking much of your time, here we go.

This blog is in three parts:

1. Hii-Hello which you have covered.

2. List of deductions available to Individuals Including Salaried persons.

3. List of benefits available to Salaried Persons.

Here is the first part of Blog, relating to Individual (and also for Salaried) taxpayers :

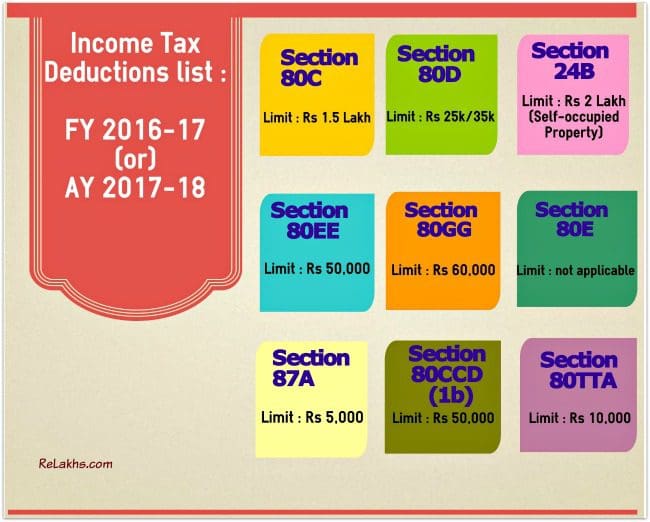

Income Tax Deductions FY 2016-17

Section 80c

The maximum tax exemption limit under Section 80C has been retained as Rs 1.5 Lakhs only. The various investment avenues or expenses that can be claimed as tax deductions under section 80c are as below;

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- Five year Bank or Post office Tax saving Deposits

- NSC (National Savings Certificates)

- ELSS Mutual Funds (Equity Linked Saving Schemes)

- Kid’s Tuition Fees

- SCSS (Post office Senior Citizen Savings Scheme)

- Principal repayment of Home Loan

- NPS (National Pension System)

- Life Insurance Premium

- Sukanya Samriddhi Account Deposit Scheme

Section 80CCC

Contribution to annuity plan of LIC (Life Insurance Corporation of India) or any other Life Insurance Company for receiving pension from the fund is considered for tax benefit. The maximum allowable Tax deduction under this section is Rs 1.5 Lakhs.

Section 80CCD

Employee can contribute to Government notified Pension Schemes (like National Pension Scheme – NPS). The contributions can be upto 10% of the salary (or) Gross Income and Rs 50,000 additional tax benefit u/s 80CCD (1b) was proposed in Budget 2015.

To claim this deduction, the employee has to contribute to Govt recognized Pension schemes like NPS. The 10% of salary limit is applicable for salaried individuals and Gross income is applicable for non-salaried. The definition of Salary is only ‘Dearness Allowance.’ If your employer also contributes to Pension Scheme, the whole contribution amount (10% of salary) can be claimed as tax deduction under Section 80CCD (2).

Kindly note that the Total Deduction under section 80C, 80CCC and 80CCD(1) together cannot exceed Rs 1,50,000 for the financial year 2016-17. The additional tax deduction of Rs 50,000 u/s 80CCD (1b) is over and above this Rs 1.5 Lakhs limit.

Section 80D

Deduction u/s 80D on health insurance premium is Rs 25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the age of 80 years who are not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes: Self, spouse, dependent children and parents).

Section 80DD

You can claim up to Rs 75,000 for spending on medical treatments of your dependents (spouse, parents, kids or siblings) who have 40% disability. The tax deduction limit of upto Rs 1.25 lakhs in case of severe disability can be availed.

To claim this deduction, you have to submit Form no 10-IA.

Section 80DDB

An individual (less than 60 years of age) can claim upto Rs 40,000 for the treatment of specified critical ailments. This can also be claimed on behalf of the dependents. The tax deduction limit under this section for Senior Citizens is Rs 60,000 and for very Senior Citizens (above 80 years) the limit is Rs 80,000.

To claim Tax deductions under Section 80DDB, it is mandatory for an individual to obtain ‘Doctor Certificate’ or ‘Prescription’ from a specialist working in a Govt or Private hospital.

For the purposes of section 80DDB, the following shall be the eligible diseases or ailments:

- Neurological Diseases where the disability level has been certified to be of 40% and above;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

- Malignant Cancers

- Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

- Chronic Renal failure

- Hematological disorders

- Hemophilia

- Thalassaemia

Section 24 (B)

The interest component of home loans is allowed as deduction under Section 24B for up to Rs 2 lakhs in case of a self-occupied house. If your property is a let-out one then the entire interest amount can be claimed as tax deduction. (Read: Understanding Tax Implications of Income from house property)

Section 80EE

This is a new proposal which has been made in Budget 2016-17. First time Home Buyers can claim an additional Tax deduction of up to Rs 50,000 on home loan interest payments u/s 80EE. The below criteria has to be met for claiming tax deduction under section 80EE.

- The home loan should have been sanctioned in FY 2016-17.

- Loan amount should be less than Rs 35 Lakhs.

- The value of the house should not be more than Rs 50 Lakhs &

- The home buyer should not have any other existing residential house in his name.

Section 80U

This is similar to Section 80DD. Tax deduction is allowed for the tax assessee who is physically and mentally challenged.

Section 80GG

As per the budget 2016 proposal, the Tax Deduction amount under 80GG has been increased from Rs 24,000 per annum to Rs 60,000 per annum. Section 80GG is applicable for all those individuals who do not own a residential house & do not receive HRA (House Rent Allowance).

The extent of tax deduction will be limited to the least amount of the following;

- Rent paid minus 10 percent the adjusted total income.

- Rs 5,000 per month.

- 25 % of the total income.

Section 80G

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. This deduction can only be claimed when the contribution has been made via cheque or draft or in cash. But deduction is not allowed for donations made in cash exceeding Rs 10,000. In-kind contributions such as food material, clothes, medicines etc do not qualify for deduction under section 80G.

Section 80E

If you take any loan for higher studies (after completing Senior Secondary Exam), tax deduction can be claimed under Section 80E for interest that you pay towards your Education Loan. This loan should have been taken for higher education for you, your spouse or your children or for a student for whom you are a legal guardian. Principal Repayment on educational loan cannot be claimed as tax deduction.

There is no limit on the amount of interest you can claim as deduction under section 80E. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

Section 87A Rebate

If you are earning below Rs 5 lakhs, you can save an additional Rs 3,000 in taxes. Tax rebate under Section 87A has been raised from Rs 2,000 to Rs 5,000 for FY 2016-17 (AY 2017-18).

In case if your tax liability is less than Rs 5,000 for FY 2016-17, the rebate u/s 87A will be restricted up to income tax liability only.

Section 80 TTA

Deduction from gross total income of an individual or HUF, up to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account with a bank, co-operative society or post office can be claimed under this section. Section 80TTA deduction is not available on interest income from fixed deposits.

Helpful Source: https://www.relakhs.com. Thanks.

Now is the third part specifically for Salaried persons:

[AY 2017-18]

S. N.

|

Section

|

Particulars

|

Benefits

|

A.

|

Allowances

| ||

1.

|

House Rent Allowance (Sec. 10(13A) & Rule 2A)

|

Least of the following is exempt:

a) Actual HRA Received

b) 40% of Salary (50%, if house situated in Mumbai, Calcutta, Delhi or Madras)

c) Rent paid minus 10% of salary

* Salary= Basic + DA (if part of retirement benefit) + Turnover based Commission

Note:

i. Fully Taxable, if HRA is received by an employee who is living in his own house or if he does not pay any rent

ii. It is mandatory for employee to report PAN of the landlord to the employer if rent paid is more than Rs. 1,00,000 [Circular No. 08 /2013 dated 10th October, 2013].

| |

2.

|

Children Education Allowance

|

Up to Rs. 100 per month per child up to a maximum of 2 children is exempt

| |

3.

|

Hostel Expenditure Allowance

|

Up to Rs. 300 per month per child up to a maximum of 2 children is exempt

| |

4.

|

Transport Allowance granted to an employee to meet expenditure on commuting between place of residence and place of duty

|

Up to Rs. 1,600 per month (Rs. 3,200 per month for blind and handicapped employees) is exempt

| |

5.

|

Transport Allowance to an employee working in any transport business to meet his personal expenditure during his duty performed in the course of running of such transport from one place to another place provided employee is not in receipt of daily allowance.

|

Amount of exemption shall be lower of following:

a) 70% of such allowance; or

b) Rs. 10,000 per month.

| |

6.

|

Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office

|

Exempt to the extent of expenditure incurred

| |

7.

|

Any Allowance granted to meet the cost of travel on tour or on transfer

|

Exempt to the extent of expenditure incurred

| |

8.

|

Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty

|

Exempt to the extent of expenditure incurred

| |

9.

|

Helper/Assistant Allowance

|

Exempt to the extent of expenditure incurred

| |

10.

|

Research Allowance granted for encouraging the academic research and other professional pursuits

|

Exempt to the extent of expenditure incurred

| |

11.

|

Uniform Allowance

|

Exempt to the extent of expenditure incurred

| |

12.

|

Foreign allowances or perquisites paid or allowed by Government to its employees (an Indian citizen) posted outside India

|

Fully Exempt

| |

13.

|

-

|

Allowances to Judges of High Court/Supreme Court (Subject to certain conditions)

|

Fully Exempt.

|

14.

|

Following allowances and perquisites given to serving Chairman/Member of UPSC is exempt from tax:

a) Value of rent free official residence

b) Value of conveyance facilities including transport allowance

c) Sumptuary allowance

d) Leave travel concession

|

Fully Exempt

| |

15.

|

-

|

Allowances paid by the UNO to its employees

|

Fully Exempt

|

16.

|

Allowances to Retired Chairman/Members of UPSC (Subject to certain conditions)

|

Exempt subject to maximum of Rs.14,000 per month for defraying services of an orderly and for secretarial assistant on contract basis.

The value of residential telephone free of cost and the number of free calls to the extent of 1500 per month shall be exempt.

| |

17.

|

Special compensatory Allowance (Hilly Areas) (Subject to certain conditions and locations)

|

Amount exempt from tax varies from Rs. 300 per month to Rs. 7,000 per month.

| |

18.

|

Border area allowances, Remote Locality allowance or Disturbed Area allowance or Difficult Area Allowance (Subject to certain conditions and locations)

|

Amount exempt from tax varies from Rs. 200 per month to Rs. 1,300 per month.

| |

19.

|

Tribal area allowance given in (a) Madhya Pradesh (b) Tamil Nadu (c) Uttar Pradesh (d) Karnataka (e) Tripura (f) Assam (g) West Bengal (h) Bihar (i) Orissa

|

Rs. 200 per month

| |

20.

|

Compensatory Field Area Allowance. If this exemption is taken, employee cannot claim any exemption in respect of border area allowance (Subject to certain conditions and locations)

|

Rs. 2,600 per month

| |

21.

|

Compensatory Modified Area Allowance. If this exemption is taken, employee cannot claim any exemption in respect of border area allowance (Subject to certain conditions and locations)

|

Rs. 1,000 per month

| |

22.

|

Counter Insurgency Allowance granted to members of Armed Forces operating in areas away from their permanent locations. If this exemption is taken, employee cannot claim any exemption in respect of border area allowance (Subject to certain conditions and locations)

|

Rs. 3,900 per month

| |

23.

|

Underground Allowance is granted to employees working in uncongenial, unnatural climate in underground mines

|

Up to Rs. 800 per month

| |

24.

|

High Altitude Allowance is granted to armed forces operating in high altitude areas (Subject to certain conditions and locations)

|

a) Up to Rs. 1,060 per month (for altitude of 9,000 to 15,000 feet)

b) Up to Rs. 1,600 per month (for altitude above 15,000 feet)

| |

25.

|

Highly active field area allowance granted to members of armed forces (Subject to certain conditions and locations)

|

Up to Rs. 4,200 per month

| |

26.

|

Island Duty Allowance granted to members of armed forces in Andaman and Nicobar and Lakshadweep group of Island (Subject to certain conditions and locations)

|

Up to Rs. 3,250 per month

| |

B.

|

Perquisites

| ||

1.

|

read with

|

Rent free unfurnished accommodation provided to Central and State Government employees

|

License Fees determined in accordance with rules framed by Government for allotment of houses shall be deemed to be the taxable value of perquisites.

|

2.

|

read with

|

Unfurnished rent free accommodation provided to other employees

|

Taxable value of perquisites

A. If House Property is owned by the employer:

i. 15% of salary, if population of city where accommodation is provided exceeds 25 lakhs as per 2001 census

ii. 10% of salary, if population of city where accommodation is provided exceeds 10 lakhs but does not exceed 25 lakhs as per 2001 census

iii. 7.5% of salary, if accommodation is provided in any other city

B. If House Property is taken on lease or rent by the employer, the perquisite value shall be :

i. Lease rent paid or payable by the employer or 15% of the salary, whichever is lower

*Salary includes:

a) Basic Pay

b) Dearness Allowance (only to the extent it forms part of retirement benefit salary)

c) Bonus

d) Commission

e) All other allowances (only taxable portion)

f) Any monetary payment which is chargeable to tax

But does not include

i. Value of any perquisite [under section 17(2)]

ii. Employer’s contribution to PF

iii. Benefits received at the time of retirement like gratuity, pension etc.

Note:

1) Rent free accommodation is not chargeable to tax if provided to an employee working at mining site or an on-shore oil exploration site, etc.,—

(i) which is being of temporary nature (subject to conditions)

(ii) which is located in remote area.

2) Rent free accommodation if provided to High Court or Supreme Court Judges, Union Ministers, Leader of Opposition in Parliament, an official in Parliament and Serving Chairman and members of UPSC is Tax Free Perquisites.

3) The value so determined shall be reduced by the amount of rent, if any, paid by the employee.

4) If employee is transferred and retain property at both the places, the taxable value of perquisites for initial period of 90 days shall be determined with reference to only one accommodation (at the option of the assessee). The other one will be tax free. However after 90 days, taxable value of perquisites shall be charged with reference to both the accommodations.

|

3.

|

read with

|

Rent free furnished accommodation

|

Taxable value of perquisites

a) Find out taxable value of perquisite assuming accommodation to be provided to the employee is unfurnished

b) Add: 10% of original cost of furniture and fixtures (if these are owned by the employer) or actual higher charges paid or payable (if these are taken on rent by the employer).

Note: The value so determined shall be reduced by the amount of rent, if any, paid by the employee

|

4.

|

read with

|

A furnished accommodation in a Hotel

|

Taxable value of perquisites

Value of perquisite shall be lower of following:

a) Actual charges paid or payable by the employer to such hotel

b) 24% of salary

Note: Hotel accommodation will not be chargeable to tax if :

a) It is provided for a total period not exceeding in aggregate 15 days in the financial year; and

b) Such accommodation in hotel is provided on employee’s transfer from one place to another place.

|

5.

|

read with Rule 3(2)

|

Motor Car / Other Conveyance

|

Taxable value of perquisites (See Note 1 below)

|

6.

|

read with Rule 3(3)

|

Services of a domestic servant including sweeper, gardener, watchmen or personal attendant

(Taxable in case of specified employee only [See Note 4])

|

Taxable value of perquisite shall be salary paid or payable by the employer for such services less any amount recovered from the employee.

|

7.

|

read with Rule 3(4)

|

Supply of gas, electricity or water for household purposes

|

Taxable value of perquisites:

1. Manufacturing cost per unit incurred by the employer., if provided from resources owned by the employer;

2. Amount paid by the employer, if purchased by the employer from outside agency

Note:

i. Any amount recovered from the employee shall be deducted from the taxable value of perquisite.

ii. Taxable in case of specified employees only [See note 4]

|

8.

|

read with Rule 3(5)

|

Education Facilities

|

Taxable value of perquisites (See Note 2 below)

|

9.

|

read with Rule 3(6)

|

Transport facilities provided by the employer engaged in carriage of passenger or goods (except Airlines or Railways)

(Taxable in case of specified employee only [See Note 4])

|

Value at which services are offered by the employer to the public less amount recovered from the employee shall be a taxable perquisite

|

10.

|

Amount payable by the employer to effect an insurance on life of employee or to effect a contract for an annuity

|

Fully Taxable

| |

11.

|

ESOP/ Sweat Equity Shares

|

Taxable value of perquisites

Fair Market value of shares or securities on the date of exercise of option by the assessee less amount recovered from the employee in respect of such shares shall be the taxable value of perquisites.

Fair Market Value shall be determined as follows:

a) In case of listed Shares: Average of opening and closing price as on date of exercise of option (Subject to certain conditions and circumstances)

b) In case of unlisted shares/ security other than equity shares: Value determined by a Merchant Banker as on date of exercise of option or an earlier date, not being a date which is more than 180 days earlier than the date of exercise of the option.

| |

12.

|

Employer’s contribution towards superannuation fund

|

Taxable in the hands of employee to the extent such contribution exceed Rs.1,50,000

| |

13.

|

17(2)(viii) read with Rule 3(7)(i)

|

Interest free loan or Loan at concessional rate of interest

|

Interest free loan or loan at concessional rate of interest given by an employer to the employee (or any member of his household) is a perquisite chargeable to tax in the hands of all employees on following basis:

1. Find out the ‘maximum outstanding monthly balance’ (i.e. the aggregate outstanding balance for each loan as on the last day of each month);

2. Find out rate of interest charged by the SBI as on the first day of relevant previous year in respect of loan for the same purpose advanced by it;

3. Calculate interest for each month of the previous year on the outstanding amount (mentioned in point 1) at the rate of interest (given in point 2)

4. Interest actually recovered, if any, from employee

5. The balance amount (point 3-point 4) is taxable value of perquisite

Nothing is taxable if:

a) Loan in aggregate does not exceed Rs 20,000

b) Loan is provided for treatment of specified diseases (Rule 3A) like neurological diseases, Cancer, AIDS, Chronic renal failure, Hemophilia (specified diseases). However, exemption is not applicable to so much of the loan as has been reimbursed to the employee under any medical insurance scheme.

|

14.

|

17(2)(viii) read with Rule 3(7)(ii)

|

Facility of travelling, touring and accommodation availed of by the employee or any member of his household for any holiday

|

a) Perquisite value taxable in the hands of employee shall be expenditure incurred by the employer less amount recovered from employee.

b) Where such facility is maintained by the employer, and is not available uniformly to all employees, the value of benefit shall be taken to be the value at which such facilities are offered by other agencies to the public less amount recovered from employee.

|

15.

|

17(2)(viii) read with Rule 3(7)(iii)

|

Free food and beverages provided to the employee

|

1) Fully Taxable: Free meals in excess of Rs. 50 per meal less amount paid by the employee shall be a taxable perquisite

2) Exempt from tax: Following free meals shall be exempt from tax

a) Food and non-alcoholic beverages provided during working hours in remote area or in an offshore installation;

b) Tea, Coffee or Non-Alcoholic beverages and Snacks during working hours are tax free perquisites;

c) Food in office premises or through non-transferable paid vouchers usable only at eating joints provided by an employer is not taxable, if cost to the employer is Rs. 50(or less) per meal.

|

16.

|

17(2)(viii) read with Rule 3(7)(iv)

|

Gift or Voucher or Coupon on ceremonial occasions or otherwise provided to the employee

|

a) Gifts in cash or convertible into money (like gift cheque) are fully taxable

b) Gift in kind up to Rs.5,000 in aggregate per annum would be exempt, beyond which it would be taxable.

|

17.

|

17(2)(viii) read with Rule 3(7)(v)

|

Credit Card

|

a) Expenditure incurred by the employer in respect of credit card used by the employee or any member of his household less amount recovered from the employee is a taxable perquisite

b) Expenses incurred for official purposes shall not be a taxable perquisite provided complete details in respect of such expenditure are maintained by the employer

|

18.

|

17(2)(viii) read with Rule 3(7)(vi)

|

Free Recreation/ Club Facilities

|

a) Expenditure incurred by the employer towards annual or periodical fee etc. (excluding initial fee to acquire corporate membership) less amount recovered from the employee is a taxable perquisite

b) Expenses incurred on club facilities for the official purposes are exempt from tax.

c) Use of health club, sports and similar facilities provided uniformly to all employees shall be exempt from tax.

|

19.

|

17(2)(viii) read with Rule 3(7)(vii)

|

Use of movable assets of the employer by the employee is a taxable perquisite

|

Taxable value of perquisites

a) Use of Laptops and Computers: Nil

b) Movable asset other than Laptops, computers and Motor Car*: 10% of original cost of the asset (if asset is owned by the employer) or actual higher charges incurred by the employer (if asset is taken on rent) less amount recovered from employee.

*See Note 1 for computation of perquisite value in case of use of the Motor Car

|

20.

|

17(2)(viii) read with Rule 3(7)(viii)

|

Transfer of movable assets by an employer to its employee

|

Taxable value of perquisites

a) Computers, Laptop and Electronics items: Actual cost of asset less depreciation at 50% (using reducing balance method) for each completed year of usage by employer less amount recovered from the employee

b) Motor Car: Actual cost of asset less depreciation at 20% (using reducing balance method) for each completed year of usage by employer less amount recovered from the employee

c) Other movable assets: Actual cost of asset less depreciation at 10% (on SLM basis) for each completed year of usage by employer less amount recovered from the employee.

|

21.

|

17(2)(viii) read with Rule 3(7)(ix)

|

Any other benefit or amenity extended by employer to employee

|

Taxable value of perquisite shall be computed on the basis of cost to the employer (under an arm’s length transaction) less amount recovered from the employee.

However expenses on telephones including a mobile phone incurred by the employer on behalf of employee shall not be treated as taxable perquisite.

|

22.

|

Tax paid by the employer on perquisites (not provided for by way of monetary payments) given to employee

|

Fully exempt

| |

23.

|

Leave Travel Concession or Assistance (LTC/LTA), extended by an employer to an employee for going anywhere in India along with his family*

*Family includes spouse, children and dependent brother/sister/parents. However, family doesn’t include more than 2 children of an Individual born on or after 01-10-1998.

|

The exemption shall be limited to fare for going anywhere in India along with family twice in a block of four years:

i. Exemption limit where journey is performed by Air - Air fare of economy class in the National Carrier by the shortest route or the amount spent, whichever is less

ii. Exemption limit where journey is performed by Rail - Air-conditioned first class rail fare by the shortest route or the amount spent, whichever is less

iii. Exemption limit if places of origin of journey and destination are connected by rail but the journey is performed by any other mode of transport - Air-conditioned first class rail fare by the shortest route or the amount spent, whichever is less

iv. Exemption limit where the places of origin of journey and destination are not connected by rail:

a. Where a recognized public transport system exists - First Class or deluxe class fare by the shortest route or the amount spent, whichever is less

b. Where no recognized public transport system exists - Air conditioned first class rail fare by shortest route or the amount spent, whichever is less

Notes:

i. Two journeys in a block of 4 calendar years is exempt

ii. Taxable only in case of Specified Employees [See note 4]

| |

24.

|

Proviso to section 17(2)

|

Medical facilities in India

|

1) Expense incurred or reimbursed by the employer for the medical treatment of the employee or his family (spouse and children, dependent - parents, brothers and sisters) in any of the following hospital is not chargeable to tax in the hands of the employee:

a) Hospital maintained by the employer.

b) Hospital maintained by the Government or Local Authority or any other hospital approved by Central Government

c) Hospital approved by the Chief Commissioner having regard to the prescribed guidelines for treatment of the prescribed diseases.

2) Medical insurance premium paid or reimbursed by the employer is not chargeable to tax.

3) Any other expenditure incurred or reimbursed by the employer for providing medical facility in India is not chargeable to tax up to Rs. 15,000 in aggregate per assessment year.

|

25.

|

Proviso to section 17(2)

|

Medical facilities outside India

|

Any expenditure incurred or reimbursed by the employer for medical treatment of the employee or his family member outside India is exempt to the extent of following (subject to certain condition):

a) Expenses on medical treatment - exempt to the extent permitted by RBI.

b) Expenses on stay abroad for patient and one attendant - exempt to the extent permitted by RBI.

c) Cost on travel of the employee or any family or one attendant - exempt, if Gross Total Income (before including the travel expenditure) of the employee, does not exceed Rs. 2,00,000.

|

C.

|

Deduction from salary

| ||

1.

|

Entertainment Allowance received by the Government employees (Fully taxable in case of other employees)

|

Least of the following is deductible :

a) Rs 5,000

b) 1/5th of salary (excluding any allowance, benefits or other perquisite)

c) Actual entertainment allowance received

| |

2.

|

Employment Tax/Professional Tax.

|

Amount actually paid during the year is deductible. However, if professional tax is paid by the employer on behalf of its employee than it is first included in the salary of the employee as a perquisite and then same amount is allowed as deduction.

| |

D.

|

Retirement Benefits

| ||

a) Leave Encashment

| |||

1.

|

Encashment of unutilized earned leave at the time of retirement of Government employees

|

Fully Exempt

| |

2.

|

Encashment of unutilized earned leave at the time of retirement of other employees (not being a Government employee)

|

Least of the following shall be exempt from tax:

a) Amount actually received

b) Unutilized earned leave* X Average monthly salary

c) 10 months Average Salary**

d) Rs. 3,00,000

*While computing unutilized earned leave, earned leave entitlements cannot exceed 30 days for each year of service rendered to the current employer

**Average salary = Average Salary*** of last 10 months immediately preceding the retirement

***Salary = Basic Pay + Dearness Allowance (to the extent it forms part of retirement benefits)+ turnover based commission

| |

b) Retrenchment Compensation

| |||

1.

|

Retrenchment Compensation received by a workman under the Industrial Dispute Act, 1947(Subject to certain conditions).

|

Least of the following shall be exempt from tax:

a) an amount calculated as per section 25F(b) of the Industrial Disputes Act, 1947;

b) Rs. 5,00,000; or

c) Amount actually received

Note:

i. Relief under Section 89(1) is available

ii. 15 days average pay for each completed year of continuous service or any part thereof in excess of 6 months is to be adopted under section 25F(b) of the Industrial Disputes Act, 1947.

| |

c) Gratuity

| |||

1.

|

Gratuity received by Government Employees (Other than employees of statutory corporations)

|

Fully Exempt

| |

2.

|

Death -cum-Retirement Gratuity received by other employees who are covered under Gratuity Act, 1972 (other than Government employee) (Subject to certain conditions).

|

Least of following amount is exempt from tax:

1. (*15/26) X Last drawn salary** X completed year of service or part thereof in excess of 6 months.

2. Rs. 10,00,000

3. Gratuity actually received.

*7 days in case of employee of seasonal establishment.

** Salary = Last drawn salary including DA but excluding any bonus, commission, HRA, overtime and any other allowance, benefits or perquisite

| |

3.

|

Death -cum-Retirement Gratuity received by other employees who are not covered under Gratuity Act, 1972 (other than Government employee) (Subject to certain conditions).

|

Least of following amount is exempt from tax:

1. Half month’s Average Salary* X Completed years of service

2. Rs. 10,00,000

3. Gratuity actually received.

*Average salary = Average Salary of last 10 months immediately preceding the month of retirement

** Salary = Basic Pay + Dearness Allowance (to the extent it forms part of retirement benefits)+ turnover based commission

| |

d) Pension

| |||

1.

|

-

|

Pension received from United Nation Organization by the employee of his family members

|

Fully Exempt

|

2.

|

Commuted Pension received by an employee Central Government, State Government, Local Authority Employees and Statutory Corporation

|

Fully Exempt

| |

3.

|

Commuted Pension received by other employees who also receive gratuity

|

1/3 of full value of commuted pension will be exempt from tax

| |

4.

|

Commuted Pension received by other employees who do not receive any gratuity

|

1/2 of full value of commuted pension will be exempt from tax

| |

5.

|

Family Pension received by the family members of Armed Forces

|

Fully Exempt

| |

6.

|

Family pension received by family members in any other case

|

33.33% of Family Pension subject to maximum of Rs. 15,000 shall be exempt from tax

| |

e) Voluntary Retirement

| |||

1.

|

Amount received on Voluntary Retirement or Voluntary Separation (Subject to certain conditions)

|

Least of the following is exempt from tax:

1) Actual amount received as per the guidelines i.e. least of the following

a) 3 months salary for each completed year of services

b) Salary at the time of retirement X No. of months of services left for retirement; or

2) Rs. 5,00,000

| |

f) Provident Fund

| |||

1.

|

-

|

Employee’s Provident Fund

|

For taxability of contribution made to various employee’s provident fund and interest arising thereon see Note 3.

|

g) National Pension System (NPS)

| |||

| 1. | 10(12A) | National Pension System | Any payment from the National Pension System Trust to an employee on closure of his account or on his opting out of the pension scheme referred to in section 80CCD, to the extent it does not exceed 40% of the total amount payable to him at the time of such closure or his opting out of the scheme. |

E.

|

Arrear of Salary and relief under section 89(1)

| ||

1.

|

Arrear of salary and advance salary

|

Taxable in the year of receipt. However relief under section 89 is available

| |

2.

|

Relief under Section 89

|

If an individual receives any portion of his salary in arrears or in advance or receives profits in lieu of salary, he can claim relief as per provisions of section 89 read with rule 21A

| |

F.

|

Other Benefits

| ||

1.

|

-

|

Lump-sum payment made gratuitously or by way of compensation or otherwise to widow or other legal heirs of an employee who dies while still in active service [Circular No. 573, dated 21-08-1990]

|

Fully Exempt in the hands of widow or other legal heirs of employee

|

2.

|

-

|

Ex-gratia payment to a person (or legal heirs) by Central or State Government, Local Authority or Public Sector Undertaking consequent upon injury to the person or death of family member while on duty [Circular No. 776, dated 08-06-1999]

|

Fully Exempt in the hands of individual or legal heirs

|

3.

|

-

|

Salary received from United Nation Organization [Circular No. 293, dated 10-02-1981]

|

Fully Exempt

|

4.

|

Salary received by foreign national as an officials of an embassy, high commission, legation, consulate or trade representation of a foreign state

|

Fully Exempt if corresponding official in that foreign country enjoys a similar exemption

| |

5.

|

Remuneration received by non-resident foreign citizen as an employee of a foreign enterprise for services rendered in India, if:

a) Foreign enterprise is not engaged in any trade or business in India

b) His stay in India does not exceed in aggregate a period of 90 days in such previous year

c) Such remuneration is not liable to deducted from the income of employer chargeable under this Act

|

Fully exempt

| |

6.

|

Salary received by a non-resident foreign national for services rendered in connection with his employment on a foreign ship if his total stay in India does not exceed 90 days in the previous year.

|

Fully exempt

| |

7.

|

-

|

Salary and allowances received by a teacher /professor from SAARC member state (Subject to certain conditions).

|

Fully Exempt

|

Notes:

1. Motor Car (taxable only in case of specified employees [See note 4]) except when car owned by the employee is used by him or members of his household wholly for personal purposes and for which reimbursement is made by the employer)

S. No.

|

Circumstances

|

Engine Capacity upto 1600 cc (value of perquisite )

|

Engine Capacity above 1600 cc (value of perquisite)

|

1

|

Motor Car is owned or hired by the employer

| ||

1.1

|

Where maintenances and running expenses including remuneration of the chauffeur are met or reimbursed by the employer.

| ||

1.1-A

|

If car is used wholly and exclusively in the performance of official duties.

|

Fully exempt subject to maintenance of specified documents

|

Fully exempt subject to maintenance of specified documents

|

1.1-B

|

If car is used exclusively for the personal purposes of the employee or any member of his household.

|

Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. of the cost of vehicle less any amount charged from the employee for such use is taxable

| |

1.1-C

|

The motor car is used partly in the performance of duties and partly for personal purposes of the employee or any member of his household.

|

Rs. 1,800 per month (plus Rs. 900 per month, if chauffeur is also provided to run the motor car)

|

Rs. 2,400 per month (plus Rs. 900 per month, if chauffeur is also provided to run the motor car)

|

Nothing is deductible in respect of any amount recovered from the employee.

| |||

1.2

|

Where maintenances and running expenses are met by the employee.

| ||

1.2-A

|

If car is used wholly and exclusively in the performance of official duties.

|

Not a perquisite, hence, not taxable

|

Not a perquisite, hence, not taxable

|

1.2-B

|

If car is used exclusively for the personal purposes of the employee or any member of his household

|

Expenditure incurred by the employer (i.e. hire charges, if car is on rent or normal wear and tear at 10% of actual cost of the car) plus salary of chauffeur if paid or payable by the employer minus amount recovered from the employee.

| |

1.2-C

|

The motor car is used partly in the performance of duties and partly for personal purposes of the employee or any member of his household

|

Rs. 600 per month (plus Rs. 900 per month, if chauffeur is also provided to run the motor car)

|

Rs. 900 per month (plus Rs. 900 per month, if chauffeur is also provided to run the motor car)

|

Nothing is deductible in respect of any amount recovered from the employee.

| |||

2

|

Motor Car is owned by the employee

| ||

2.1

|

Where maintenances and running expenses including remuneration of the chauffeur are met or reimbursed by the employer.

| ||

2.1-A

|

The reimbursement is for the use of the vehicle wholly and exclusively for official purposes

|

Fully exempt subject to maintenance of specified documents

|

Fully exempt subject to maintenance of specified documents

|

2.1-B

|

The reimbursement is for the use of the vehicle exclusively for the personal purposes of the employee or any member of his household

|

Actual expenditure incurred by the employer minus amount recovered from the employee

| |

2.1-C

|

The reimbursement is for the use of the vehicle partly for official purposes and partly for personal purposes of the employee or any member of his household.

|

Actual expenditure incurred by the employer minus Rs. 1800 per month and Rs. 900 per month if chauffer is also provided minus amount recovered from employee.

|

Actual expenditure incurred by the employer minus Rs. 2400 per month and Rs. 900 per month if chauffer is also provided minus amount recovered from employee.

|

3

|

Where the employee owns any other automotive conveyance and actual running and maintenance charges are met or reimbursed by the employer

| ||

3.1

|

Reimbursement for the use of the vehicle wholly and exclusively for official purposes;

|

Fully exempt subject to maintenance of specified documents

|

Fully exempt subject to maintenance of specified documents

|

3.2

|

Reimbursement for the use of vehicle partly for official purposes and partly for personal purposes of the employee.

|

Actual expenditure incurred by the employer minus Rs. 900 per month minus amount recovered from employee

|

Not Applicable

|

2. Educational Facilities

Taxable only in the hands of specified employees [See note 4]

Facility extended to

|

Value of perquisite

| |

Provided in the school owned by the employer

|

Provided in any other school

| |

Children

|

Cost of such education in similar school less Rs. 1,000 per month per child (irrespective of numbers of children) less amount recovered from employee

|

Amount incurred less amount recovered from employee (an exemption of Rs. 1,000 per month per child is allowed)

|

Other family member

|

Cost of such education in similar school less amount recovered from employee

|

Cost of such education incurred

|

2.1 Other Educational Facilities

Particulars

|

Taxable Value of Perquisites

|

Reimbursement of school fees of children or family member of employees

|

Fully taxable

|

Free educational facilities/ training of employees

|

Fully exempt

|

3. Employees Provident Fund

Tax treatment in respect of contributions made to and payment from various provident funds are summarized in the table given below:

Particulars

|

Statutory provident fund

|

Recognized provident fund

|

Unrecognized provident fund

|

Public provident fund

|

Employers contribution to provident fund

|

Fully Exempt

|

Exempt only to the extent of 12% of salary*

|

Fully Exempt

|

-

|

Deduction under section 80C on employees contribution

|

Available

|

Available

|

Not Available

|

Available

|

Interest credited to provident fund

|

Fully Exempt

|

Exempt only to the extent rate of interest does not exceed 9.5%

|

Fully Exempt

|

Fully Exempt

|

Payment received at the time of retirement or termination of service

|

Fully Exempt

|

Fully Exempt (Subject to certain conditions and circumstances)

|

Fully Taxable (except employee’s contribution)

|

Fully Exempt

|

* Salary = Basic Pay + Dearness Allowance (to the extent it forms part of retirement benefits) + turnover based commission

Payment from recognized provident fund shall be exempt in the hands of employees in following circumstances:

a) If employee has rendered continue service with his employer (including previous employer, when PF account is transferred to current employer) for a period of 5 years or more

b) If employee has been terminated because of certain reasons which are beyond his control (ill health, discontinuation of business of employer, etc.)

4. Specified Employee

The following employees are deemed as specified employees:

1) A director-employee

2) An employee who has substantial interest (i.e. beneficial owner of equity shares carrying 20% or more voting power) in the employer-company

3) An employee whose monetary income* under the salary exceeds Rs. 50,000

*Monetary Income means Income chargeable under the salary but excluding perquisite value of all non-monetary perquisites

[As amended by Finance Act, 2016]

Source: http://www.incometaxindia.gov.in

Your suggestions are always welcome for improvements or for any mistake therein.

Disclaimer: This blog is for Information purpose. This does not constitute professional advice. Kindly consult your professional personnel before acting on it. No one will be held responsible for any act done on the sole basis of the above blog.

No comments:

Post a Comment